- Dapatkan link

- Aplikasi Lainnya

- Dapatkan link

- Aplikasi Lainnya

The concept of cash laundering is essential to be understood for those working in the financial sector. It's a process by which dirty cash is converted into clean money. The sources of the cash in actual are felony and the money is invested in a means that makes it seem like clear cash and conceal the identity of the felony a part of the cash earned.

Whereas executing the financial transactions and establishing relationship with the new customers or maintaining present customers the obligation of adopting ample measures lie on every one who is a part of the group. The identification of such component to start with is straightforward to cope with as a substitute realizing and encountering such conditions later on within the transaction stage. The central bank in any nation supplies complete guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present sufficient safety to the banks to discourage such situations.

The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a US. Congress outlined recordkeeping and reporting requirements for banks allowing federal authorities to use the information for.

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

What is the Bank Secrecy Act.

Bank secrecy act usa. Still it continues to be one of the most crucial sources of regulation for American and global financial systems with wide-ranging effects across the sector. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. Treasury is the delegated administrator of the BSA.

The Bank Secrecy Act BSA is the United States most important anti money laundering regulation. IBs have been interpreted by FinCEN to fit within the term brokers or dealers in commodities in the financial institution definition and thus also must establish AML Programs. Bank Secrecy Act also called Currency and Foreign Transactions Reporting Act US.

Richard Nixon that requires banks and other financial entities in the United States to maintain records and file reports on currency transactions and. The Bank Secrecy Act is a law that was implemented in 1970 as a means to detect and prevent the movement of illicit funds through the legitimate banking system. The US Bank Secrecy Act BSA is being implemented in 1970.

The BSA is intended to combat money laundering and ensure that banks and financial institutions do not facilitate or become complicit in it. Legislation signed into law in 1970 by Pres. 180-Day Update on AML Act Implementation June 30 2021 WASHINGTONFinancial Crimes Enforcement Network FinCEN Acting Director Michael Mosier today announced FinCENs delivery of two key requirements pursuant to the Anti-Money Laundering of 2020 the AML Act which includes the Corporate Transparency Act.

The Bank Secrecy Act BSA is US. These funds were primarily the. 11 terrorist attacks criminalized the financing of terrorism and strengthened the existing BSA framework.

The law requires financial institutions to provide. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Message from the FinCEN Director.

FinCEN in turn entrusts the federal banking agencies with. This Section amends the Bank Secrecy Act by imposing due diligence enhanced due diligence requirements on US. What is the Bank Secrecy Act or BSA.

Suspicious Activity Reports SAR. Also known as the Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 Enacted to help in the investigation of money laundering tax evasion and other criminal activity What does the Bank Secrecy Act Include. The Bank Secrecy Act BSA requires financial institutions banks to maintain records and report information to federal authorities.

Banks and other financial institutions must ensure they meet the compliance obligations it involves. 1730d and 1829b and all regulations promulgated thereunder and the Bank has properly certified all foreign deposit accounts. Introduced in 1970 the Bank Secrecy Act BSA is the United States most important anti-money laundering law.

The Bank Secrecy Act BSA 31 USC 5318h requires financial institutions to establish Anti-Money Laundering AML ProgramsFCMs are defined as financial institutions in the BSA. The purpose of the BSA is to require United States US. The Bank Secrecy Act BSA is the United States of Americas most crucial anti-money laundering regulation.

The Currency and Foreign Transactions Reporting Act of 1970 commonly referred to as the Bank Secrecy Act or BSA is the primary US. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. The Bank is in compliance in all material respects with the Bank Secrecy Act 12 USC.

Special Due Diligence Programs for Certain Foreign Accounts. The Bank Secrecy Act. Specifically this anti-money laundering law requires regulated financial institutions to keep records of.

Law used to detect deter and disrupt money laundering and terrorist financing networks. The Financial Crimes Enforcement Network FinCEN a bureau of the US. The USA PATRIOT Act passed in response to the Sept.

5311 et seq is referred to as the Bank Secrecy Act BSA. Financial institutions that maintain correspondent accounts for foreign financial institutions or private banking accounts for non-US. Bank Secrecy Act Currency Transactions for more than 10000 CTR Multiple currency transactions more than 10000 PurchaseSale of Monetary Instruments 3000 - 10000 Report of International Transportation of Currency and Monetary Instrument Report CMIR.

The name refers to the purpose of the law which is to avoid bank secrecy. Government agencies in detecting and preventing money laundering. Law requiring financial institutions in the United States to assist US.

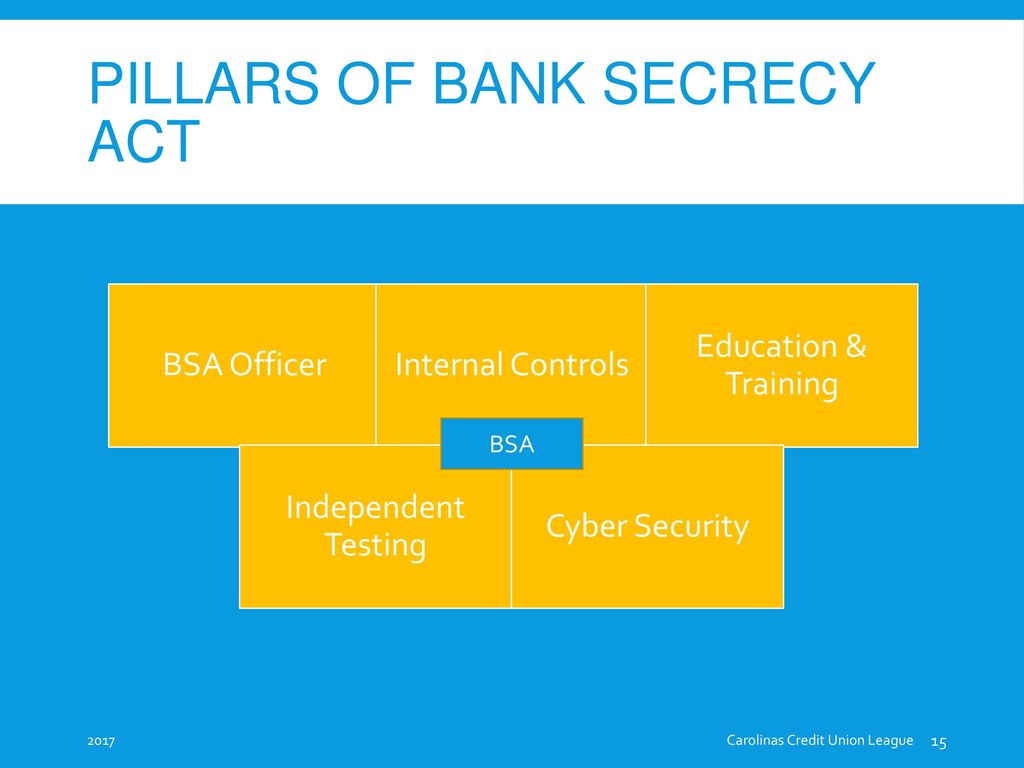

The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks.

Bank Secrecy Act Bsa Bsa Aml Cip Ofac For Loan Officers

Bank Secrecy Act Bsa Bsa Aml Cip Ofac For Loan Officers

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Bsa Aml Ofac Staff Training Ppt Download

What Is Fincen How Does It Regulate Virtual Currencies Sygna

Bank Secrecy Act Bsa Bsa Aml Cip Ofac For Loan Officers

1970 To 2021 The Us Anti Money Laundering Act History Complyadvantage

1970 To 2021 The Us Anti Money Laundering Act History Complyadvantage

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

The Bank Secrecy Act Five Decades Of Fighting Financial Crime

Bank Secrecy Act Anti Money Laundering Examination Manual U S Government Bookstore

Ppt Bank Secrecy Act Powerpoint Presentation Free Download Id 522035

Bank Secrecy Act Compliance Usps Office Of Inspector General

Fiscal Year 2017 Bank Secrecy Act Program Usps Office Of Inspector General

The world of laws can appear to be a bowl of alphabet soup at instances. US money laundering regulations are no exception. We have compiled a list of the top ten money laundering acronyms and their definitions. TMP Danger is consulting firm centered on defending monetary providers by lowering risk, fraud and losses. We now have huge bank experience in operational and regulatory threat. Now we have a robust background in program management, regulatory and operational danger in addition to Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many adverse consequences to the organization due to the risks it presents. It will increase the likelihood of main risks and the opportunity price of the bank and finally causes the financial institution to face losses.

Komentar

Posting Komentar